Massachusetts Senior Benefits Calculator

Check which benefits you qualify for based on your age and circumstances.

Your Eligibility Results

Enter your age to see which benefits you qualify for.

When you hear the term senior citizen, you might picture someone with gray hair, retired, and enjoying quiet afternoons. But in Massachusetts, that label isn’t just about age-it’s about what you can access. The truth is, there’s no single age that unlocks everything. Depending on the program, the cutoff could be 60, 62, or 65. And knowing the difference can mean the difference between saving hundreds a year or paying full price.

Most Programs Use Age 60 as the Starting Point

In Massachusetts, many state-run benefits begin at age 60. This includes things like reduced fares on public transit, discounts at state parks, and eligibility for the Massachusetts Senior Nutrition Program. If you’re 60 or older, you can get free or low-cost meals delivered to your home or served at local senior centers. You can also apply for the Senior Prescription Insurance Program (SPIP), which helps cover out-of-pocket costs for prescriptions. These programs don’t wait until 65. They recognize that financial strain and health needs often start earlier.

For example, the MBTA’s Senior Fare program gives people 60+ a 50% discount on subway, bus, and commuter rail rides. That’s not a perk-it’s a lifeline for those living on fixed incomes. Same goes for the Massachusetts Department of Elder Affairs-they offer free legal advice, home repair grants, and caregiver support starting at 60.

Medicare and Social Security Kick In at 65

But when it comes to federal programs, the rules change. Medicare, the government health plan for older adults, only begins at age 65. Even if you’re 62 and retired, you still need to pay for private insurance until then. Social Security retirement benefits are another story. You can start collecting as early as 62, but your monthly payout is permanently reduced. Full retirement age in Massachusetts-like everywhere else in the U.S.-is currently 67 for people born in 1960 or later.

This creates a gap. Someone who turns 60 might get free meals and transit discounts, but still have to pay full price for doctor visits and prescriptions. That’s why many seniors in Massachusetts stretch their savings between 60 and 65, often relying on part-time work or family support. It’s not uncommon to see 63-year-olds still working retail or driving for rideshare apps just to keep their health insurance.

Age 62: The Hidden Threshold for Housing and Tax Relief

There’s another age that doesn’t get talked about much: 62. That’s the cutoff for the Massachusetts Property Tax Relief Program for seniors. If you’re 62 or older and own your home, you might qualify for a tax exemption or deferral. The program looks at your income and how long you’ve lived in the home. You don’t need to be 65. Just 62. And if you’re a widow or widower, the rules are even more flexible.

Similarly, some cities and towns in Massachusetts offer their own senior discounts on utilities or garbage collection at age 62. Springfield, Worcester, and Lowell all have local programs that kick in before 65. So while state-wide benefits start at 60, local ones can start even earlier.

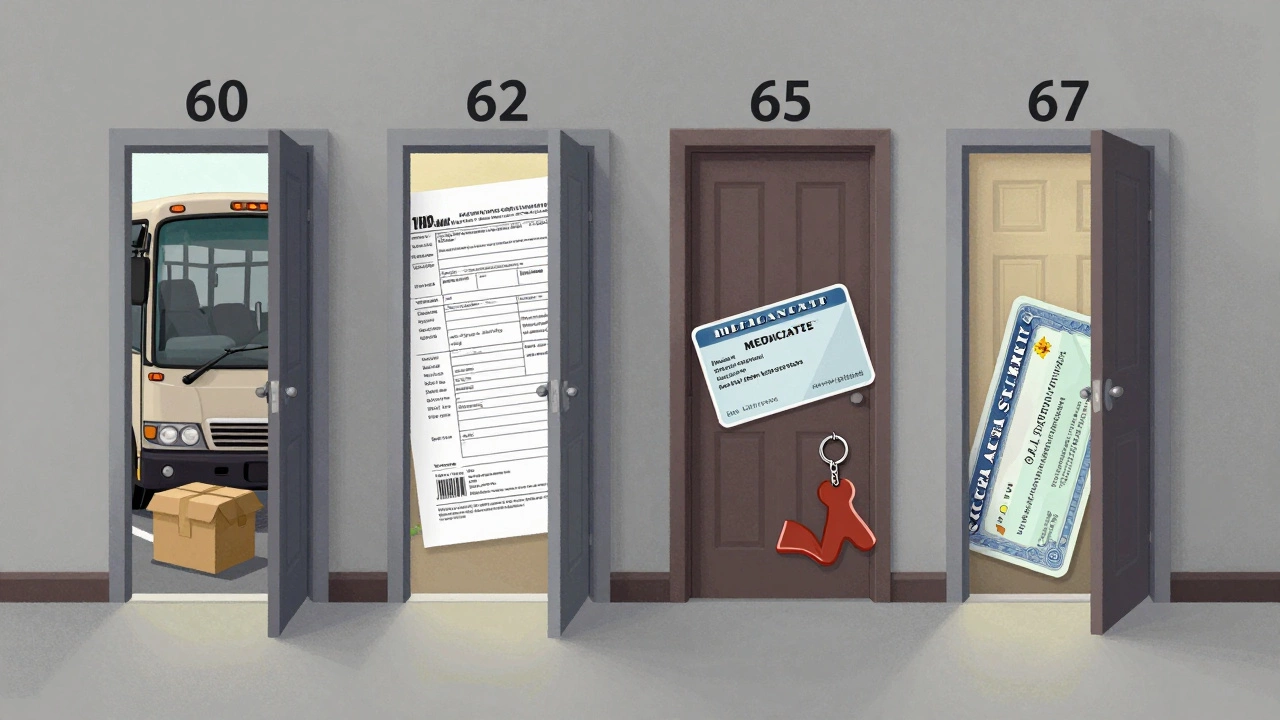

Why the Confusion? It’s Not One Age-It’s a Ladder

The reason people get confused is simple: there’s no universal definition. The state doesn’t have one official “senior citizen” age. Instead, it’s a ladder. Each rung-60, 62, 65, 67-opens a different door. Think of it like a keychain:

- At 60: You get transit discounts, meals, and state-level assistance.

- At 62: You can apply for property tax relief and some local utility discounts.

- At 65: You qualify for Medicare and full Social Security benefits (if you wait until then).

- At 67: You reach full retirement age for maximum Social Security payments.

There’s no single card that says “Senior Citizen.” You collect benefits based on which program you’re applying for. That’s why it’s so important to check each one individually.

What You Can Do Right Now

If you’re 60 or older and live in Massachusetts, here’s what to do next:

- Visit the Massachusetts Executive Office of Elder Affairs website and use their benefit finder tool.

- Call your local Area Agency on Aging-they’ll walk you through what you qualify for, no paperwork required.

- Check with your city hall about local tax or utility discounts.

- If you’re on Medicare, make sure you’ve enrolled on time. Late enrollment can mean higher premiums.

- Don’t assume you’re ineligible just because you’re not 65. Many people miss out because they wait too long.

One woman in Cambridge, 61, found out she qualified for $1,200 a year in property tax relief just by asking. She’d been paying full tax since she turned 60, thinking she had to wait until 65. She didn’t know about the 62 rule.

What About People Under 60?

Even if you’re not 60 yet, it’s worth paying attention. Programs like the Medicaid Buy-In for Workers with Disabilities and the MassHealth Care for Seniors program sometimes include people under 60 who have long-term care needs. And if you’re caring for an aging parent, you might qualify for caregiver support services regardless of your own age.

There’s also the growing number of “young seniors”-people in their late 50s who are retired early due to health issues or job loss. Massachusetts is starting to recognize this group. Some nonprofit organizations now offer food pantries and mental health services to people as young as 55 who are struggling financially.

Final Thought: Don’t Wait for the Official Label

There’s no magic moment when you suddenly become a senior citizen in Massachusetts. It’s not like turning 18 or 21. It’s a series of small doors opening at different ages. The trick is to keep checking. Don’t wait for someone to tell you you’re eligible. Ask. Call. Visit. The state doesn’t always advertise these benefits loudly-but they’re there.

And if you’re helping someone else-whether it’s a parent, neighbor, or friend-don’t assume they know. Many seniors don’t use the internet or trust government websites. A simple phone call from someone they trust can unlock years of savings.

Is 60 the official age for senior citizen status in Massachusetts?

No, there’s no single official age. Different programs use different cutoffs. Most state benefits start at 60, but Medicare and full Social Security require age 65. Property tax relief begins at 62. So while 60 is the most common starting point, it’s not the only one.

Can I get senior discounts before I turn 60?

Generally, no-for state-run benefits, 60 is the minimum. But some local programs, like utility discounts or library passes, may start at 55 or 58. It varies by city. Also, if you have a disability or are caring for a senior, you may qualify for support services regardless of age.

Do I need to apply for senior status?

You don’t apply for a general "senior citizen" status. Instead, you apply for specific programs: transit discounts, tax relief, nutrition services, etc. Each has its own application process. The state doesn’t issue cards or IDs for senior status-it’s all program-specific.

What if I’m 64 and still working? Do I still qualify for anything?

Yes. Even if you’re still working, you can qualify for senior discounts on transit, meals, and property tax relief if you’re 60 or older. You just won’t be eligible for Medicare until you turn 65. Many people in their early 60s keep working while accessing state benefits to stretch their income.

Is there a income limit to qualify as a senior citizen in Massachusetts?

For most discounts-like transit or park entry-there’s no income limit. But for programs like property tax relief, prescription assistance, or Medicaid, your income and assets are reviewed. The state doesn’t deny you senior status based on income, but it does limit certain benefits to those with lower incomes.